The FinTech sector in the South West contributes more than £1bn to the regional economy annually and supports a workforce of nearly 19,000 in more than 190 firms, according to new analysis.

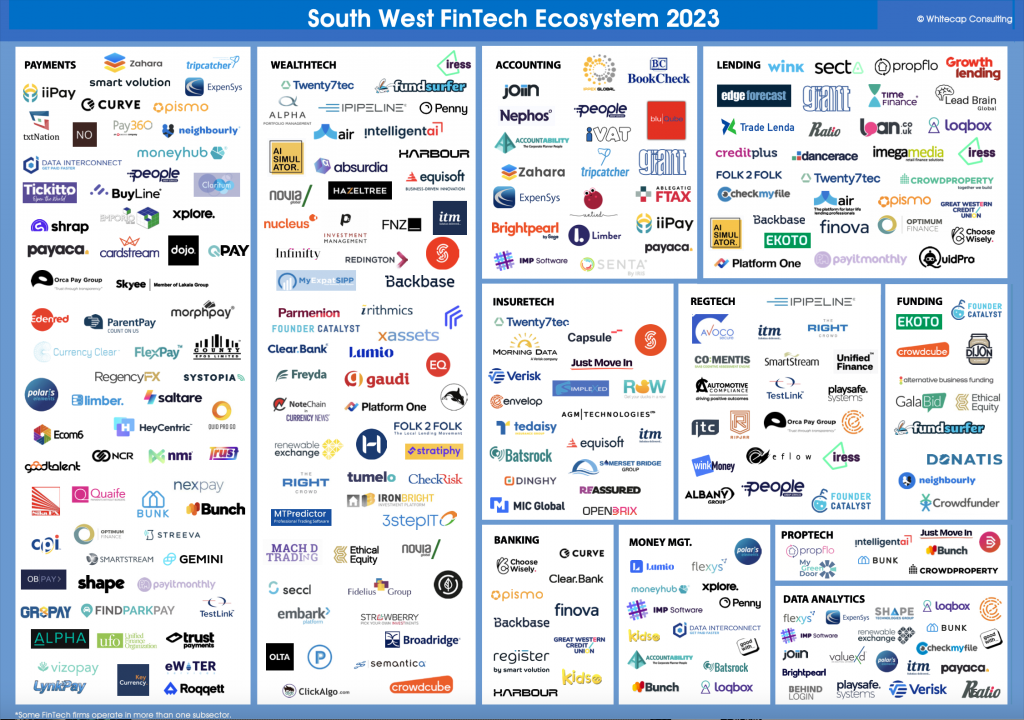

The report published by Whitecap Consulting, the regional strategy consultancy with a base in Bristol, reveals the South West’s core FinTech strengths are in payments, WealthTech and lending.

However, there is also a strong ‘FinTech for good’ sub-sector of firms, especially in WealthTech, it shows.

The report echoes earlier research by Whitecap in the Bristol-Bath city region, which showed its burgeoning FinTech businesses were helping to create one of the strongest fintech ecosystems in the country, with a high number of fast-growing start-ups and scale-ups.

That report, published in 2020, found 107 businesses in the sector, more than any other region of the UK.

Of these, 28 were start-ups and scale-ups, meaning the West of England enjoyed a larger number of early-stage fintech firms than areas with populations more than three or four times its size.

It also showed that more than 3,400 people were employed in fintech-related roles in the area out of a total of 61,000 in financial services and tech sectors.

Since that report was released, the government’s Kalifa Review – a strategic report on the UK FinTech published in February 2021 – highlighted the strength of key regional FinTech clusters across the UK, naming Bristol & Bath as one of the top 10 clusters.

The new analysis covers the whole of the South West region, from Wiltshire and Gloucestershire to Dorset and Cornwall, and involved the development of data and insights relating to the FinTech capability and potential of the region.

Whitecap Consulting director and FinTech lead Julian Wells, pictured, said: “The UK’s FinTech sector continues to grow despite the challenging economic environment, and our research shows the South West is highly active in the sector.

“Our analysis identifies continued strong growth in that region, but the story of FinTech across the South West spans much further afield, and we’re proud to put the spotlight on the whole region via this new report.”

The report is the result of a collaborative research project which was funded through sponsorship and support from organisations including international law firm Osborne Clarke, which has a major office in Bristol, Amdaris and the Bristol-headquartered software development and digital services specialist.

Other supporters included Taunton and London open payment firm Cardstream, global data group Integration Works, which has an office in Bath, inward investment agency Invest Bristol & Bath, accountants RSM, the University of the West of England and FinTech West, the organisation that champions the South West as a tech powerhouse.

Osborne Clarke corporate partner Mark Wesker, pictured, added: “As the main sponsor of this report, and hosts of the recent FinTech West conference in Bristol, we are proud to have supported this project and to help shine the spotlight on the substantial and varied range of FinTech activity across the South West.

“Osborne Clarke has grown from its South West roots to become a leading international legal adviser for FinTechs and we are keen to support the industry.”

The South West is increasingly linked into national FinTech activity. The University of Bristol and FinTech West will lead a first-of-its-kind £1.8m research programme to accelerate innovation adoption in SMEs and mid-tier financial services firms.

Called Future Finance and funded by Innovate UK/ESRC, the innovation adoption accelerator will work closely with smaller financial services firms to understand the challenges they face and explore how technology and innovation can help.

The South West also has a leading role in ongoing engagement with the new Centre for Finance, Innovation & Technology (CFIT), including being involved in regionally-based organisations in the initial CFIT coalition, which focuses on Open Finance.

CFIT CEO Ezechi Britton MBE said: “It is exceptionally motivating to read this report which highlights the crucial role the South West is playing in advancing the FinTech sector and bolstering the financial well-being of the broader community.

“The various regional initiatives and activities over the past few years have clearly had a strong positive impact on the region.

“The South West is home to some of the UK’s most prominent UK FinTech brands, as well as some of the most esteemed universities and educational institutions in the country.

“With a vibrant pipeline of skills, key strengths in payments, WealthTech and lending, as well as a new ESRC-funded national FinTech accelerator, it is an area with much to offer to the national agenda.”

The report is Whitecap’s 14th published report on regional FinTech activity in the UK. The firm has analysed more than 1,000 individual FinTech firms based outside London over the past three years, including around 650 in the last 12 months.

To download the full report visit: https://www.whitecapconsulting.co.uk/press-release/new-report-finds-large-established-fintech-sector-across-south-west/