Bath’s acquisition-hungry media group Future has hit the takeover trail again with a near £600m offer for the firm behind the Co Compare website.

The £594m cash-and-shares offer, which has been accepted by GoCo Group’s board, was revealed on the same day that Future posted a 300% increase in annual pre-tax profits to £52m on sales up 53% at £340m.

Its financial results, for the 12 month to September 30, also show the group’s magazine sales and some of its events were hit by the coronavirus pandemic but opportunities for new titles opened up as people were forced to stay at home.

Future’s rapid growth over recent years – mainly through a raft of acquisitions in the UK and US – has taken it a long to way to fulfilling its strategy of becoming a specialist global media platform with diversified revenue streams.

It says its content now reaches over one in three adults online in both the UK and the US – a far cry six years ago when it plunged to a £35.4m annual loss and was forced to sell titles, axe staff and shake up its management team as part of root-and-branch cost-cutting exercise.

Its high-growth Media division now spans eCommerce, events and digital advertising in sectors ranging from tech, games & entertainment, and home & gardens, to sports, women’s lifestyle and B2B with brands including TechRadar, PC Gamer, Guitar World and Gardening Etc, Adventure and Tom's Hardware.

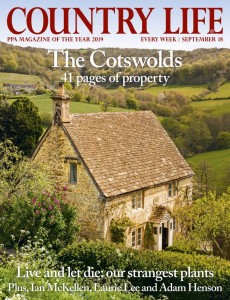

Its Magazine division focuses on publishing specialist content with more than 115 magazines, and 410 bookazines published a year boasting a combined global circulation of more than 3m. The portfolio include titles such as Country Life, Wallpaper, Woman & Home, Total Film and Music Week.

Future chief executive Zillah Byng-Thorne said: “Our exceptional results, which are ahead of expectations, demonstrate the continued strength of our strategy, as well as the innovation, fortitude and agility of our business, focused on its purpose, delivered by its people.

“I am extremely proud of the way our colleagues have rapidly adapted to address the challenging market resulting from the Covid-19 pandemic over recent months.

“Future has continued to thrive by knowing what our audiences value most, enabling us to take advantage of the changing market landscape to continue to deliver incredible content to our communities in whatever way meets their needs.

“Our leadership positions are underpinned by a track record of strong, consistent organic growth, and accelerated through acquisitions. The long-term fundamentals of growing global digital advertising spend and eCommerce growth add to our confidence that, despite continued market uncertainty, we remain well-positioned to continue our strong growth.”

She said Future’s directors believed the recommended Offer for GoCo Group would deliver significant long-term shareholder value.

“Through the acquisition, we expect to create a leading offering for consumers, providing complementary insights that enable consumers to make informed choices in their passions, interests and key purchasing decisions.

“The transaction will bring together our depth of audience insight and reach with GoCo’s expertise in price comparison, underpinned by the proprietary technology of both groups.”

Future said the impact of retail closures during the coronavirus pandemic resulted in approximately £20m of lost magazine sales.

But it said despite this, the lockdown period presented it with a valuable opportunity to trial new titles and launch into print media sectors that reflected the sudden shift in reader interests. Market data highlighted a surge in popularity of topics such as wellbeing and mindfulness, hobbies, puzzles and pastimes, and it was able to respond with a number of new bookazines that have proven to be popular, it said.

The GoCo deal, if approved, would mean that the group’s non-executive chairman Sir Peter Wood – the insurance industry veteran, founder of Direct Line and, at one time, the UK’s highest-paid company director – would hold around a 5.5% stake in Future.